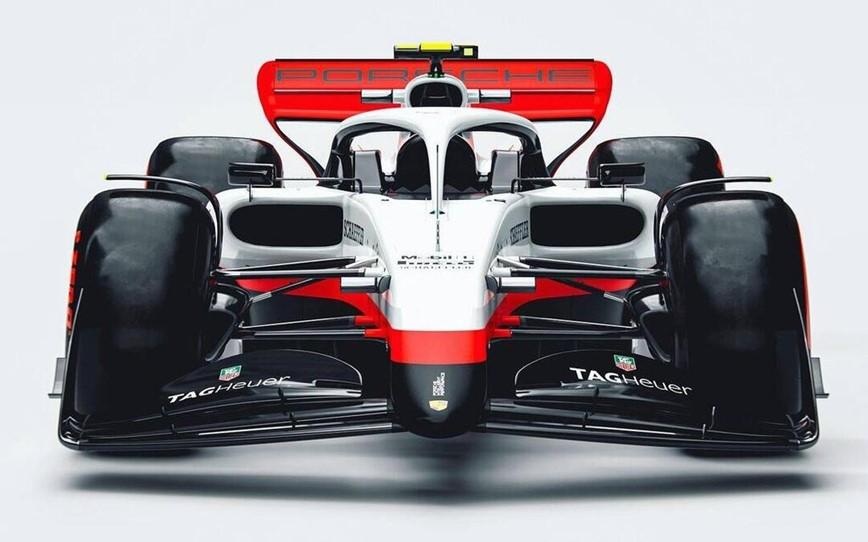

Porsche, the iconic German automaker, has set its sights on Formula 1, signaling a potential seismic shift in the sport’s landscape. Recent announcements indicate that Porsche is exploring two distinct pathways to enter the pinnacle of motorsport: acquiring the Alpine F1 team or forming a strategic partnership with the American racing outfit Andretti Global. This development has sparked intense speculation within the motorsport community, as Porsche’s return to Formula 1 could reshape team dynamics, technological innovation, and the sport’s global appeal.

Porsche’s interest in Formula 1 is not entirely new. The brand has a storied history in motorsport, with successful ventures in endurance racing, including multiple Le Mans victories, and a current partnership with Andretti in Formula E. However, its ambitions in Formula 1 have gained momentum following the Volkswagen Group’s broader strategy to expand its presence in the sport. In 2022, Porsche’s talks with Red Bull Racing fell through, leaving the manufacturer to explore alternative routes. Now, with the 2026 season on the horizon and new engine regulations emphasizing sustainability, Porsche sees an opportune moment to join the grid.

One potential avenue is the acquisition of Alpine, the Formula 1 team owned by Renault. Alpine has faced challenges in recent years, with inconsistent on-track performance and internal turmoil, including the departure of key personnel. Reports suggest that Porsche is in discussions with Renault to purchase the Enstone-based team, a move that would grant Porsche immediate access to Formula 1’s infrastructure, including a competitive chassis and a well-established operational base. Such a deal would also allow Porsche to leverage its expertise in power unit development, aligning with the 2026 regulations that prioritize hybrid technology and sustainable fuels. Acquiring Alpine could position Porsche as a full works team, giving it control over both chassis and engine development—a significant advantage in a sport where integration is key.

However, the Alpine deal is not without hurdles. Renault’s commitment to Formula 1, despite Alpine’s struggles, remains a point of pride for the French manufacturer. Selling the team could be seen as a retreat from the sport, potentially damaging Renault’s brand image. Moreover, the financial valuation of Alpine, estimated to be in the range of $1 billion, presents a significant investment. Porsche would need to weigh the cost against the long-term benefits of owning a team outright, especially in a sport where financial regulations like the cost cap demand efficiency.

Alternatively, Porsche is exploring a partnership with Andretti Global, the American motorsport powerhouse led by Michael Andretti. Andretti has been vocal about its desire to join Formula 1, with plans to enter as an 11th team by 2026. Despite initial resistance from Formula 1’s commercial rights holder, Liberty Media, and some existing teams, Andretti’s ambitions gained traction with General Motors’ backing through its Cadillac brand. Porsche’s existing relationship with Andretti in Formula E, where it supplies the powertrain for Andretti’s team, makes this partnership a natural fit. The collaboration has already yielded success, including a Formula E drivers’ championship for Jake Dennis in 2023, demonstrating the potential for a fruitful alliance in Formula 1.

A Porsche-Andretti partnership could see Porsche providing power units and technical expertise while Andretti handles team operations. This arrangement would allow Porsche to enter Formula 1 without the immediate burden of building a team from scratch. It would also align with Andretti’s goal of establishing an American presence in the sport, capitalizing on Formula 1’s growing popularity in the United States. However, the partnership faces challenges, including securing approval from Formula 1’s governing bodies and navigating the concerns of existing teams about revenue dilution with an additional team on the grid.

The choice between acquiring Alpine and partnering with Andretti reflects Porsche’s strategic calculus. Buying Alpine offers immediate entry and control but comes with high costs and integration risks. Collaborating with Andretti provides flexibility and leverages an existing relationship but depends on overcoming regulatory hurdles. Both paths underscore Porsche’s commitment to Formula 1’s future, particularly as the sport shifts toward electrification and sustainability—areas where Porsche excels.

As negotiations continue, the motorsport world watches closely. Porsche’s entry, whether through Alpine or Andretti, promises to bring cutting-edge technology, fierce competition, and a renewed global spotlight to Formula 1. With the 2026 season looming, the next few months will be critical in determining how Porsche’s ambitions take shape, potentially heralding a new era for the sport.